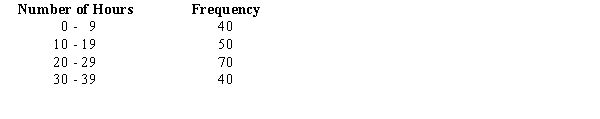

Exhibit 3-1

The following data show the number of hours worked by 200 statistics students.

-Refer to Exhibit 3-1. The relative frequency of students working 9 hours or less

Definitions:

Employer Payroll Tax Rates

The percentage rates at which employers are required to tax their employees' wages for federal and state payroll taxes.

FICA Social Security Taxes

Taxes paid by both employers and employees to fund the Social Security program, determined as a percentage of payroll.

FICA Medicare Taxes

These are taxes collected from both employers and employees in the United States to fund the Medicare program, which provides healthcare benefits for qualified individuals.

Federal Unemployment Taxes

Taxes imposed by the federal government on employers to fund state workforce agencies and unemployment insurance for workers who have lost their jobs.

Q15: Given that Z is a standard normal

Q16: To compute the probability of the LA

Q31: Connie discovers four biology majors who took

Q40: Sixty percent of the student body at

Q42: Refer to Exhibit 2-3. What percentage of

Q82: Data collected over several time periods are<br>A)time

Q109: The symbol <span class="ql-formula" data-value="\cup"><span

Q119: If the variance of a data set

Q150: The following frequency distribution shows the yearly

Q156: Refer to Exhibit 3-6. The median is<br>A)84<br>B)85<br>C)86<br>D)87