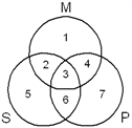

Syllogistic Form 2H

Given the following syllogistic form:

No P are M.

-For Syllogistic Form 2H, after filling in the Venn diagram,

Definitions:

Tax Law

Tax law encompasses the rules, policies, and regulations that oversee the tax process for individuals, businesses, and other entities, determining how taxes are calculated, collected, and managed.

Liability Approach

A method in accounting where emphasis is placed on accruing all expected future costs and obligations.

Income Tax Expense

The total amount of income tax a company owes to the government for a specified period, reflected in its financial statements.

Deferred Tax Liability

A tax obligation that a company will have to pay in the future, arising out of current transactions that are recognized in the financial statements before they are taxable.

Q5: In Categorical Proposition 1G, the quantity is:<br>A)

Q37: Given the argument: A ⊃ (B •

Q51: For Syllogistic Form 5F, the mood and

Q56: For Syllogistic Form 2A, after filling in

Q133: For Syllogistic Form 5I, the mood and

Q181: (S ⊃ Q) • (∼W ⊃ ∼C)

Q246: After reducing the number of terms in

Q258: No A are non-B. (T) Obversion<br>A) No

Q291: Given the pair of statements: (A ∨

Q347: All non-A are B. (T) No non-A