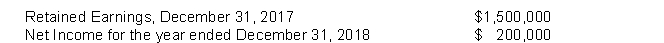

The following information is available for Zip Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2018, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2018, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on equipment in 2016 and 2017 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $35,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2018.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2018.

Definitions:

Effective Technique

A method or approach that has been proven to achieve desired results or objectives efficiently.

Emotional Concerns

Issues or aspects related to an individual's feelings, emotions, and psychological well-being.

Selling Points

Key features or benefits of a product or service that are emphasized to persuade potential buyers.

Successful Marketing

Marketing efforts that effectively reach the target audience and achieve the desired outcomes, such as increased sales or brand awareness.

Q6: In preparing a statement of cash flows,

Q15: Under the indirect method, retained earnings is

Q21: On October 1, Steve's Carpet Service borrows

Q55: The cost of a patent must be

Q57: The person responsible for maintaining the company's

Q128: Farris Company borrowed $800,000 from BankTwo on

Q214: Seven thousand shares of treasury stock of

Q264: A $1,000 face value bond with a

Q286: The sale of common stock below par<br>A)

Q320: A corporation has a separate _ apart