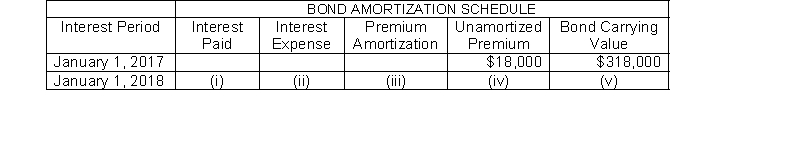

Presented here is a partial amortization schedule for Roseland Company who sold $300,000, five year 10% bonds on January 1, 2017 for $318,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (iii) ?

Which of the following amounts should be shown in cell (iii) ?

Definitions:

Nonproduction Workers

Employees who are not directly involved in the production process, including roles in administration, management, and support services.

Service-Providers

Organizations or individuals that offer services to others, often in a professional, maintenance, or consultative capacity.

Combined Distribution Plans

Retirement or benefit plans that incorporate features of both defined contribution and defined benefit plans, offering a combination of guaranteed payouts and contributions based on individual accounts.

Gain-Sharing Plans

A type of incentive plan where employees receive benefits from cost-savings or productivity improvements they contribute to, enhancing teamwork and efficiency.

Q18: Which of the following assets does not

Q23: A statement of comprehensive income is presented

Q54: Orr Corporation sold equipment for $30,000. The

Q63: Ermler Company purchased a machine at a

Q77: Additions and improvements to a plant asset

Q129: Under the allowance method, the cash realizable

Q187: The corporate charter of Martin Corporation allows

Q194: The declining-balance method of computing depreciation is

Q198: Under IFRS, the proceeds from the issuance

Q320: A corporation has a separate _ apart