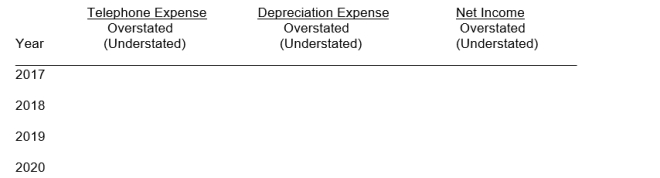

On January 1, 2016 Grier Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2017 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Grier Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2017 through the useful life of the new equipment.

Definitions:

Reliable Data

Information that consistently yields the same results over time, deemed trustworthy and accurate for making decisions.

Human Capital

A group's competencies, understanding, and unseen assets possessed by individuals, which serve to generate financial value for the persons, their companies, or their neighborhood.

Strategic Requirements

The essential conditions or resources needed for an organization to effectively implement its strategy and achieve its objectives.

Simple Regression Equation

A mathematical formula used to predict the value of a dependent variable based on the value of an independent variable.

Q24: With an interest-bearing note, a borrower must

Q27: Jim's Pharmacy has collected $600 in sales

Q67: Under the direct write-off method of accounting

Q87: Using the percentage-of-receivables basis, the uncollectible accounts

Q100: Compute the maturity date and the maturity

Q112: BE 254<br>Roxy Inc. issues a $1,500,000, 10%,

Q192: Bank errors<br>A) occur because of time lags.<br>B)

Q201: A highly automated computerized system of accounting

Q205: Research and development costs<br>A) are classified as

Q280: Management should select the depreciation method that<br>A)