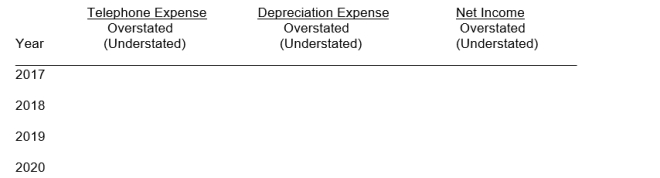

On January 1, 2016 Grier Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2017 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Grier Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2017 through the useful life of the new equipment.

Definitions:

Coding Systems

Methodologies or sets of rules used to encode or classify information for purposes such as data processing or communication.

Trust

Confidence or reliance in the integrity, strength, ability, or character of a person or concept.

Evaluations

are systematic assessments of the value, performance, or significance of an object, project, or person based on established criteria.

Leaders' Skills

The set of abilities and competencies that leaders possess to guide, motivate, and manage teams effectively.

Q3: The times interest earned is computed by

Q14: Crawford Company has total proceeds (before segregation

Q24: With an interest-bearing note, a borrower must

Q79: The three primary accounting problems with accounts

Q110: In 2018, Warehouse 13 had net credit

Q172: All of the following would involve a

Q187: The best managed companies will have<br>A) no

Q195: Admire County Bank agrees to lend Givens

Q211: A bank reconciliation is generally prepared by

Q236: The account Allowance for Doubtful Accounts is