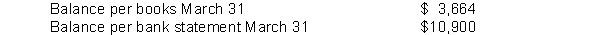

Bell Food Store developed the following information in recording its bank statement for the month of March.  -------------------------------------------

-------------------------------------------

(1) Checks written in March but still outstanding $7,000.

(2) Checks written in February but still outstanding $3,100.

(3) Deposits of March 30 and 31 not yet recorded by bank $5,200.

(4) NSF check of customer returned by bank $1,200.

(5) Check No. 210 for $593 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $539.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $3,000 plus $100 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

Definitions:

Optimal Transfer Price

The price set for goods or services sold between divisions within the same company to maximize overall company profit.

Competitive Market

A market structure characterized by a large number of buyers and sellers, similar products, and easy market entry and exit, leading to competitive prices.

Wool Fabric

A textile material derived from the fleece of sheep or other animals, known for its warmth, durability, and natural insulating properties.

Corporate Income Tax

A tax imposed on the net income (profit) of corporations, calculated at varying rates depending on the jurisdiction.

Q24: During 2018, Alfred Inc. had sales on

Q63: Understating beginning inventory will understate<br>A) assets.<br>B) cost

Q120: In periods of rising prices, the inventory

Q122: A buyer would record a payment within

Q126: A 30-day note dated June 18 has

Q134: The cash account shows a balance of

Q134: Partridge Bookstore had 500 units on hand

Q139: The custodian of the petty cash fund

Q152: Deposits in transit<br>A) have been recorded on

Q186: Under GAAP, companies generally classify income statement