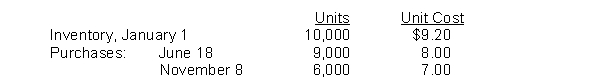

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at

Definitions:

Defined Contribution Plans

Retirement plans in which employees contribute a fixed amount or percentage of their salaries, and the final benefits depend on the plan's investment performance.

Mandatory Benefits

Benefits that employers are legally required to provide to their employees, including social security, workers' compensation, and unemployment insurance.

Total Compensation

The complete pay package for employees, including all forms of money, benefits, services, and in-kind payments.

Wages

Compensation paid to employees based on the hours worked, typically expressed as an hourly rate.

Q8: The step in the accounting cycle that

Q26: When the allowance method is used to

Q56: Romanoff Industries had the following inventory transactions

Q111: Moroni Industries has the following inventory information.

Q125: Non-operating activities exclude revenues and expenses that

Q127: Riley Company received a notice with its

Q181: The following information was available for Pete

Q200: If a company determines cost of goods

Q212: Company A sells $2,500 of merchandise on

Q222: The interest rate specified on any note