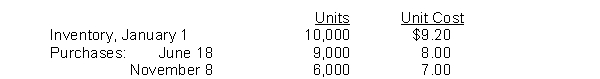

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used?

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used?

Definitions:

Leading Countries

Nations that are at the forefront in terms of economic, political, military, or technological development.

Legal Immigrants

Individuals who have been granted authorization by a country to live, work, or study there according to its laws.

Illegal Immigrants

Individuals who enter or reside in a country without the legal permission of the government.

Residing Continuously

Living in the same place without interruption or change of location over a period of time.

Q27: After gross profit is calculated, operating expenses

Q34: When the allowance method is used to

Q42: A debit memorandum could show the collection

Q92: On July 9, Sheb Company sells goods

Q92: When calculating interest on a promissory note

Q120: The basic issues in accounting for notes

Q124: On January 15, 2018, Craig Company received

Q181: The following information was available for Pete

Q200: If a company determines cost of goods

Q241: During 2018, Parker Enterprises generated revenues of