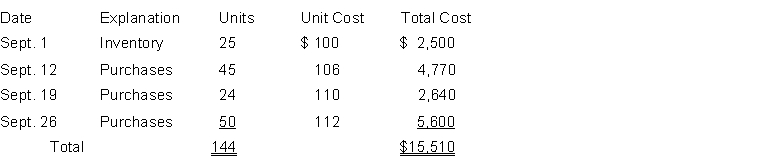

Stengel Company sells a snowboard, White-Out, that is popular with snowboard enthusiasts. Presented below is information relating to Stengel Company's purchases of White-Out snowboards during September. During the same month, 124 White-Out snowboards were sold at $160 each. Stengel Company uses a periodic inventory system.  Instructions

Instructions

(a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO method. Prove the amount allocated to cost of goods sold under each method.

(b) For both FIFO and LIFO, calculate the sum of inventory and cost of goods sold. What do you notice about the answer you found for each method?

(c) What is gross profit under each method?

(d) Which method results in a larger amount reported for assets on the balance sheet? Which results in a larger amount reported for stockholders' equity on the balance sheet?

Definitions:

Rent

A periodic fee paid for the use of property or land.

Opportunity Cost

The foregone benefit that would have been derived from an option not chosen.

Unlimited Resources

A hypothetical scenario in which there is an infinite supply of resources, making scarcity and allocation concerns non-existent.

Favorite Tv Show

The television program a person enjoys the most or has a strong preference for over others.

Q11: After a worksheet has been completed, the

Q54: Waters Hardware reported cost of the goods

Q61: The adjusted trial balance columns of a

Q74: During 2018, Parker Enterprises generated revenues of

Q114: The income statement for the year

Q147: During July, the following purchases and sales

Q159: A petty cash fund is generally established

Q197: Presented below is information for Annie

Q215: Delmar Company had beginning inventory of $90,000,

Q236: The adjusted trial balance of Dailey Music