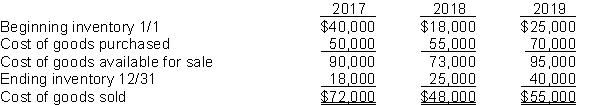

Baden's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:  Net income for the years 2017, 2018, and 2019 was $70,000, $60,000, and $55,000, respectively. Since net income was consistently declining, Mr. Baden hired a new accountant to investigate the cause(s) for the declines.

Net income for the years 2017, 2018, and 2019 was $70,000, $60,000, and $55,000, respectively. Since net income was consistently declining, Mr. Baden hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of $25,000 were not recorded in 2017.

2. The 2017 December 31 inventory should have been $24,000.

3. The 2018 ending inventory included inventory costing $5,000 that was purchased FOB destination and in transit at year end.

4. The 2019 ending inventory did not include goods costing $4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Definitions:

Infant

A young child in the earliest period of life, especially from birth to one year of age.

Tinnitus

Ringing heard in one or both ears.

Swayback

A postural condition characterized by an exaggerated inward curve of the lower back, leading to a forward tilting of the pelvis.

Spoon Nails

A nail disorder characterized by a concave, spoon-like shape of the fingernails or toenails, it can indicate iron deficiency or other health issues.

Q33: Specific Identification must be used for inventory

Q99: The following information is available for Edmiston

Q128: A reversing entry<br>A) reverses entries that were

Q153: Two widely used methods of estimating inventories

Q178: Dawson's Fashions sold merchandise for $40,000 cash

Q183: On February 28, Kerley Company had accounts

Q183: Current liabilities<br>A) are obligations that the company

Q198: In a perpetual inventory system, a return

Q211: A note which is not paid on

Q228: Which one of the following statements concerning