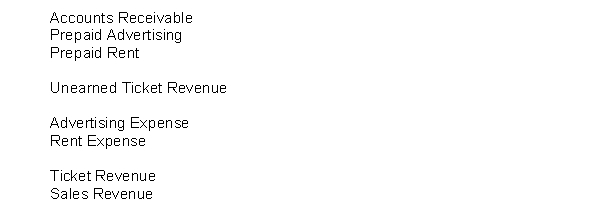

The following ledger accounts are used by the Sebastopol Dog Track:  Instructions

Instructions

For each of the following transactions below, prepare the journal entry (if one is required) to record the initial transaction and then prepare the adjusting entry, if any, required on September 30, the end of the fiscal year.

(a) On September 1, paid rent on the track facility for three months, $210,000.

(b) On September 1, sold season tickets for admission to the racetrack. The racing season is year-round with 25 racing days each month. Season ticket sales totaled $900,000.

(c) On September 1, borrowed $350,000 from First National Bank by issuing a 9% note payable due in three months.

(d) On September 5, programs for 20 racing days in September, 25 racing days in October, and 15 racing days in November were printed for $3,600.

(e) The accountant for the concessions company reported that gross receipts for September were $150,000. Ten percent is due to the track and will be remitted by October 10.

Definitions:

Conducted Surveys

The process of collecting data or feedback through structured questionnaires from a selected group of people.

Performance

The act of carrying out or accomplishing an action, task, or function.

Education And Communication

The process of imparting knowledge, skills, and information through various means, including dialogue and instruction.

Employee Resistance

The opposition or pushback from employees towards changes or policies introduced in the workplace.

Q17: In general, adjusting entries are required each

Q22: Identify which of the following accounts would

Q51: The accounting process involves all of the

Q52: Bookkeeping and accounting are one and the

Q70: Stahl Consulting started the year with total

Q80: The expense recognition principle requires that expenses

Q81: A worksheet is an optional working tool

Q133: SurferRosa Music Store borrowed $30,000 from the

Q146: The following information is for Bright Eyes

Q192: REM Real Estate received a check for