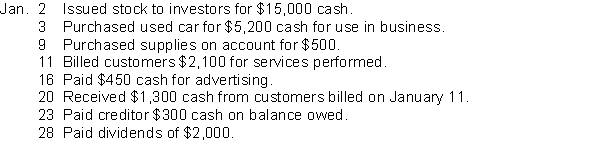

Selected transactions for Good Home, a property management company, in its first month of business, are as follows:  Instructions

Instructions

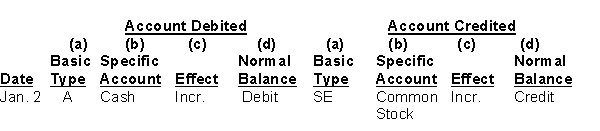

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), stockholders' equity (SE)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

Definitions:

Disposable Income

Households' financial resources for expenditure and savings following income tax deductions.

Savings

Money set aside for future use rather than spent immediately.

Savings

The portion of income not spent on current consumption or taxes, instead set aside for future use or investment.

Disposable Income

The money households have for spending and saving after subtracting income taxes.

Q13: An awareness of the normal balances of

Q19: A contingent liability should be recorded in

Q21: Instructions<br>Compute Banner's payroll tax expense for the

Q45: The Duce Company has five plants nationwide

Q45: The accounts receivable _ provides detailed information

Q47: Which of the following are the same

Q51: Expenses paid and recorded as assets before

Q128: Before month-end adjustments are made, the February

Q180: Accounting time periods that are one year

Q256: The _ assumption requires that the activities