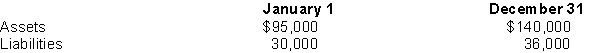

The total assets and liabilities of Company at January 1 and December 31, 2018 are presented below.  Instructions:

Instructions:

1. Assume dividends of $10,800 were paid and no additional stock was issued during the year. Revenues were $110,000. Compute (a) net income, and (b) expenses.

2. Assume additional stock was issued for $4,800 and no dividends were paid during the year. Expenses were $42,000. Compute (a) net income, and (b) revenues.

3. Assume additional stock was issued for $62,000 and dividends of $15,600 were paid during the year. Compute net income.

4. Assume additional stock was issued for $6,000 and net income was $51,000. Compute dividends paid.

Definitions:

Routine

A sequence of actions regularly followed; a fixed program for carrying out daily activities or procedures.

First Trimester Screen

A prenatal test conducted during the first trimester of pregnancy to assess the risk for certain chromosomal abnormalities, including Down syndrome.

Cystic Fibrosis

A genetic disorder that affects mostly the lungs but also the pancreas, liver, kidneys, and intestine, leading to severe respiratory and digestive problems.

Birth Defects

Anomalies that are present at birth which can affect the structure or function of the body, possibly resulting in physical or mental disabilities.

Q18: Two federal taxes which are levied against

Q28: A capital lease requires the lessee to

Q31: Assume that Oslo Corp. acquires 30% of

Q42: Which of the following economic events would

Q50: Muscle cells store more creatine phosphate than

Q60: Special journals are used to record unique

Q74: During muscle contraction, myosin cross bridges attach

Q86: Auditing is<br>A) the examination of financial statements

Q117: Kalyn Gise is the daughter of Mark

Q147: Which of the following is the correct