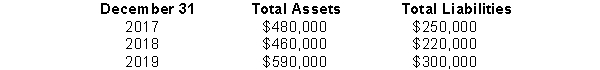

The Constantine Company had the following assets and liabilities on the dates indicated.  Constantine began business on January 1, 2017, with an investment of $100,000.

Constantine began business on January 1, 2017, with an investment of $100,000.

Instructions

From an analysis of the change in stockholders' equity during the year, compute the net income (or loss) for:

(a) 2017, assuming Constantine's dividends were $45,000 for the year.

(b) 2018, assuming Constantine made an additional investment of $50,000 and paid no dividends in 2018.

(c) 2019, assuming Constantine made an additional investment of $15,000 and paid dividends of $40,000 in 2019.

Definitions:

Demand Curves

A graphical representation used in economics to show the relationship between the price of a product and the quantity of the product that consumers are willing and able to purchase at various prices.

Long Run

When all costs become variable costs and firms can enter or leave the industry.

Covert Collusion

A secretive agreement among firms to fix prices, limit production, or divide markets, which is illegal and against regulatory policies.

Cut Throat Competition

An intense form of competition where businesses aggressively undercut each other's prices, often at the expense of profit margins.

Q1: If Sloane Joyner invests $10,514.81 now and

Q5: Financial statements are the major means of

Q24: When the periodic payments are not equal

Q50: Compute the missing amount in each category

Q55: The account Fair Value Adjustment-Trading appears as

Q66: McComb Inc. earns $1,350,000 and pays cash

Q81: Unless there is evidence to the contrary,

Q85: Camper Van Company purchased equipment for $2,600

Q151: On January 1, Chan & Chan, CPAs

Q207: GAAP, compared to IFRS, tends to be