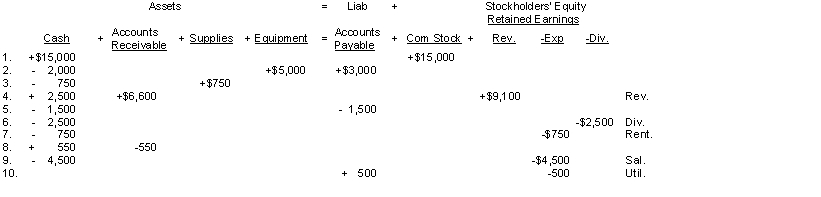

An analysis of the transactions made by Cookie Mountain Legal, a law firm, for the month of July is shown below. Each increase and decrease in stockholders' equity is explained.  Instructions

Instructions

(a) Prepare an income statement for the month ending July 31, 2018.

(b) Prepare a retained earnings statement for the month ending July 31, 2018.

Definitions:

Noncurrent Liabilities

Financial obligations of a company that are not due to be settled within one year, including long-term loans, bonds payable, and long-term lease obligations.

Current

In finance, "current" typically refers to assets and liabilities that are expected to be realized or settled within one year from the reporting date.

Interest Expense

The cost incurred by an entity for borrowed funds over a period of time.

Net Income

The amount of earnings remaining after all expenses and taxes have been subtracted from total revenue.

Q11: Which one of the following payroll taxes

Q13: What is the present value of $90,000

Q44: Druganaut Company buys a $21,000 van on

Q50: Compute the missing amount in each category

Q79: Myoglobin _.<br>A) is a protein involved in

Q136: If the cost of an available-for-sale security

Q137: Indicate in the space provided by each

Q141: The primary purpose of the statement of

Q155: The purchase of store equipment for cash

Q167: Accountants do not have to worry about