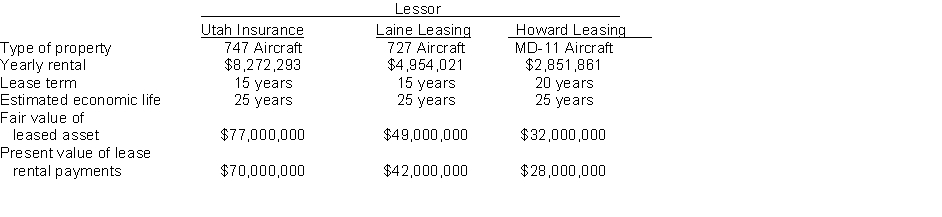

Presented below are three different aircraft lease transactions that occurred for Western Airways in 2017. All the leases start on January 1, 2017. In no case does Western receive title to the aircraft during or at the end of the lease period; nor is there a bargain purchase option.  Instructions

Instructions

(a) Which of the above leases are operating leases and which are finance leases? Explain your answer.

(b) How should the lease transaction with Utah Insurance be recorded in 2017?

(c) How should the lease transaction with Laine Leasing be recorded in 2017?

Definitions:

Profitability

The ability of a company to generate earnings above its costs and expenses over time.

Margin of Safety

The difference between actual or projected sales and the break-even point; measures the risk of not covering fixed costs.

Liabilities to Stockholders' Equity

A ratio that measures the amount of liabilities a company has compared to its shareholders' equity.

Asset Turnover Ratio

A financial metric that measures the efficiency of a company in using its assets to generate sales or revenue; it is calculated by dividing net sales by average total assets.

Q6: A subsidiary ledger is<br>A) used in place

Q8: Sandy Company uses both special journals and

Q10: Assume that the payroll records of Erroll

Q79: When investing excess cash for short periods

Q95: Sarcomeres are functional units of _ muscle.<br>A)

Q148: When a company owns more than 50%

Q177: Fair Value Adjustment is a valuation _

Q188: A debit is not the normal balance

Q208: Sources of increases to stockholder's equity are<br>A)

Q245: If a corporation distributes cash to its