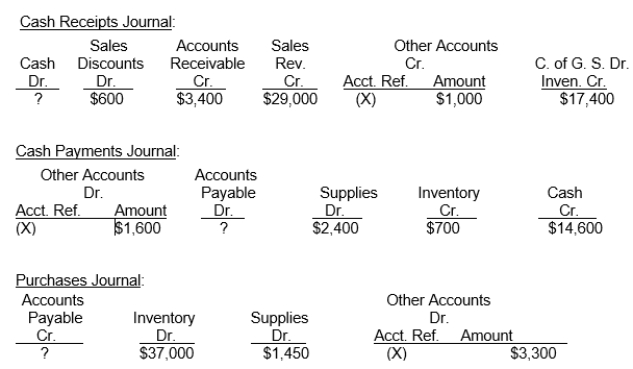

Horton Company uses four special journals, (cash receipts, cash payments, sales, and purchases journal) in addition to a general journal. On November 1, 2018, the control accounts in the general ledger had the following balances: Cash $12,000, Accounts Receivable $200,000 and Accounts Payable $42,000. Selected information on the final line of the special journals for the month of November is presented below:  Additional Data:

Additional Data:

The Sales Journal total was $41,000. A customer returned merchandise for credit for $360 and Norton Company returned store supplies to a supplier for credit for $400.

Instructions

(a) Determine the missing amounts in the special journals.

(b) Determine the balances in the general ledger accounts (Cash, Accounts Receivable, and Accounts Payable) at the end of November.

Definitions:

Underapplied Manufacturing Overhead

Refers to the situation where the actual manufacturing overhead costs are greater than the overhead costs applied to production.

Allocation

The process of distributing resources or costs among various departments, products, or activities based on specific criteria or formulas.

Journal Entry

A record in accounting that represents a transaction, showing the accounts affected and the amounts debited and credited.

Overapplied Balance

A situation in cost accounting where the amount of overhead applied to products or services exceeds the actual overhead costs incurred.

Q36: An employer's estimated cost for postretirement benefits

Q47: Lifting up a glass to take a

Q69: The reference column in a sales journal

Q79: Myoglobin _.<br>A) is a protein involved in

Q81: Unless there is evidence to the contrary,

Q103: When three or more accounts are required

Q108: If the equity method is being used,

Q118: Under the equity method, the receipt of

Q175: When a company owns more than 50%

Q226: Accounting communicates financial information about a business