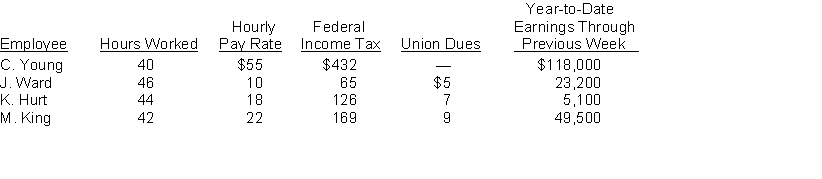

Assume that the payroll records of Erroll Oil Company provided the following information for the weekly payroll ended November 30, 2018.  Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

Definitions:

Liability-revenue Relationship

A financial concept that examines the connection between a company's incurred liabilities and the revenue generated over a certain period.

Deferred Revenue

Revenue recorded by a corporation for products or services that have not yet been provided or executed, classified as an obligation.

Accrued Revenue

Income earned but not yet received or recorded at the end of the accounting period.

Shareholders' Equity

The residual interest in the assets of a company after deducting its liabilities, representing the ownership stake of the shareholders.

Q20: Describe the difference between muscle tension, muscle

Q30: Steven, a football player, complained of severe

Q43: The amount you must deposit now in

Q61: Circle the correct answer to each situation.

Q76: La Bouisse Inc. obtained significant influence over

Q110: Under the equity method, the receipt of

Q133: Internal transactions do not affect the basic

Q228: Stahl Consulting started the year with total

Q234: The common characteristic possessed by all assets

Q241: Use the accounting equation to answer the