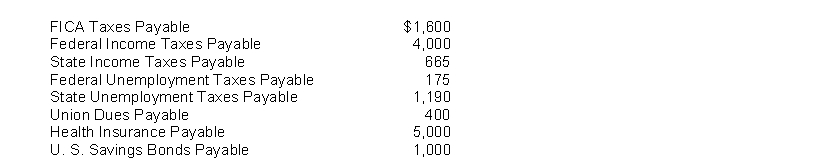

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Definitions:

Self-Interest Theory

A theory suggesting that human actions are motivated by personal gain, positing that individuals are primarily driven by self-serving interests even in decisions that appear altruistic.

Consumer's Actual

The real or existing state of consumption behavior and patterns exhibited by an individual or group, as opposed to their potential or intended actions.

Determined

Showing a firm decisiveness and purposefulness in achieving a specific goal.

Instinctive

Behavior or actions that are innate and driven by natural tendencies or genetic programming, rather than learned experience.

Q6: If total liabilities increased by $30,000 and

Q22: External transactions involve economic events between the

Q22: The journal entry to record the payroll

Q25: The entries in the Accounts Receivable Credit

Q27: Internal control over payroll is not necessary

Q45: Suzy Douglas has been offered the opportunity

Q48: Amy Brown plans to buy a surround

Q51: The transactions of Medina Information Service are

Q149: European companies rely<br>A) less on historical cost

Q162: Corporations invest in other companies for all