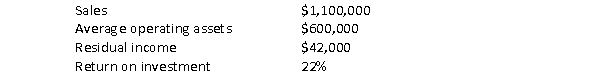

In 2009 the Porter Company reported the following information:  The company's required rate of return was: a. 11.3%

The company's required rate of return was: a. 11.3%

B) 33.3%

C) 15%

D) 29%

Definitions:

ESP

Extrasensory perception, the ability to gain information about an object, person, location, or physical event through means other than the known human senses.

Phantom Limb

A phenomenon in which individuals experience sensations, including pain, in a limb that has been amputated.

Clairvoyance

The supposed ability to gain information about an object, person, location, or physical event through extrasensory perception.

Psychokinesis

The purported psychic ability to move or manipulate objects with the mind without physical interaction, widely regarded as pseudoscience.

Q3: m = 3,passing through (1,-2)<br>A)y = 3x

Q3: Quantifying the longer-term implications of short-term actions

Q5: It is typically best for a firm

Q22: Find f'(x) for f(x) = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg"

Q23: One reason it might be profitable for

Q28: A firm would classify payments to employees

Q28: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6722/.jpg" alt=" " class="answers-bank-image

Q41: Which of the following statements is not

Q54: The Tafoya Company has budgeted the following

Q61: There are two equivalent methods for performing