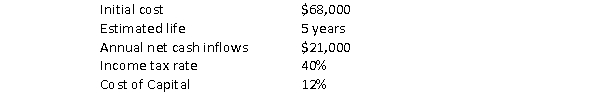

Consider the following information regarding the purchase of a piece of equipment:  Assuming the company uses straight-line depreciation, the depreciation tax shield in year 1 would amount to:

Assuming the company uses straight-line depreciation, the depreciation tax shield in year 1 would amount to:

Definitions:

Notes Receivable

Written promises for amounts to be received by a business, typically including interest, from individuals or other entities.

Bad Debt Expense

An expense reported on the income statement due to receivables that are not expected to be collected.

Recording Methods

Various approaches or systems used to document financial transactions in accounting books or software.

General Ledger

The primary ledger, when used in conjunction with subsidiary ledgers, that contains all of the balance sheet and income statement accounts.

Q12: Accounting for fixed manufacturing overhead is the

Q12: Which of the following is not a

Q13: Which of the following is not a

Q14: Attributes that we can measure for each

Q17: Our ultimate decision will differ when we

Q18: Which of the following is not a

Q21: Because the predetermined rates in process costing

Q25: Tabby Totes, a manufacturer of travel carriers

Q27: A spending variance results when there is

Q34: Smith Manufacturing uses a standard costing system.