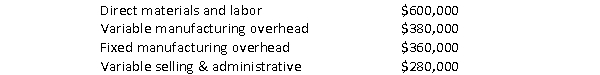

In the month of November, the Philly Company produced and sold 40,000 units of a single product. Costs incurred during the month included:  Using variable costing the unit product cost would be:

Using variable costing the unit product cost would be:

Definitions:

Ability-To-Pay Principle

A tax theory stating that taxes should be levied according to an individual or entity’s capacity to pay.

Benefits Principle

A theory in taxation stating that those who benefit from government services should pay taxes in proportion to the amount they benefit.

Government Services

Public programs and activities provided by the federal, state, and local governments to benefit their citizens.

Ability-To-Pay Principle

A taxation principle that suggests taxes should be levied according to an individual's or entity's capacity to pay, typically measured by income or wealth.

Q2: A cost that is proportional to the

Q4: Typically in process costing, separate rates are

Q5: Unlike individuals whose goals might have several

Q8: A support activity:<br>A) Is needed to run

Q11: Understanding finance is not crucial to organizations

Q26: The Custer Company began the period with

Q39: Which of the following is not a

Q41: Product costs are often referred to as

Q48: Which of the following is not a

Q83: The controller of Nationwide Bicycle Parts is