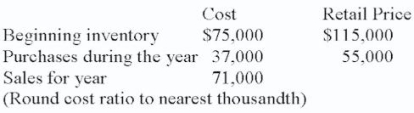

Calculate using retail method:

Definitions:

Gross Profit

The difference between revenue and the cost of making a product or providing a service, before deducting overheads, payroll, taxation, and interest payments.

Inventory Costing Method

A method used to assign costs to inventory, affecting how costs are reported in the financial statements.

Year-End Purchase

Acquisitions or purchases made by a company close to the end of its fiscal year, often impacting the annual financial statements.

LIFO Cost of Goods Sold

An inventory costing method where the last items placed in inventory are considered the first ones sold, affecting the cost of goods sold during a period.

Q2: Horizontal analysis need not be done using

Q3: Hair Shine Company produces Shine Bright

Q8: What is the impact of disposing any

Q16: Nancy Billows promised to pay her son

Q22: Incremental analysis involves calculating the difference in

Q41: A retailer purchased some trendy clothes that

Q47: Mike O'Brien plans to deposit $1,250 at

Q59: All interest-bearing notes must have the rate

Q87: Kilwin's Candies produced and sold 600 boxes

Q127: Heinz Bottling Company produces various glass and