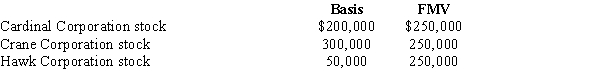

Eric, age 80, has accumulated about $6 million in net assets. Among his assets are the following marketable securities held as investments.  Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church. In addition, to consummate a land deal, he needs $250,000 in cash. Looking solely to tax: considerations and using only the assets described above, Eric's best choice is to:

Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church. In addition, to consummate a land deal, he needs $250,000 in cash. Looking solely to tax: considerations and using only the assets described above, Eric's best choice is to:

Definitions:

Sublingual Glands

Salivary glands located beneath the tongue, responsible for secreting saliva that aids in digestion and oral hygiene.

Intrinsic Factor

Factor secreted by the parietal cells of gastric glands and required for adequate absorption of vitamin B12.

Mucous Cells

Specialized cells present in various glands and tissues that produce and secrete mucus.

Parietal Cells

Cells located in the lining of the stomach that secrete hydrochloric acid and intrinsic factor.

Q2: The price of a baseball ticket at

Q2: During any month in which both the

Q11: In the number 49,869 there are how

Q12: Round 2,689 all the way:<br>A) 2,680<br>B) 3,680<br>C)

Q36: Matt and Patricia are husband and wife

Q44: Which of the following is not immune

Q114: Which of the following taxpayers can be

Q133: When Travis learns he is seriously ill,

Q156: Sally's will passes real estate to Otto

Q188: Casualty loss to property after the death