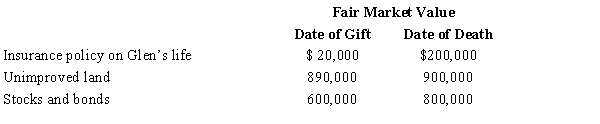

In 2013, Glen transferred several assets by gift to different persons. Glen dies in 2015. Information regarding the properties given is summarized below.

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

Definitions:

Host Country

The country in which a multinational company operates a facility or office, outside of its home country.

Managerial Control

Managerial control involves processes and systems that an organization uses to regulate activities and achieve its objectives by guiding employee behavior.

Longevity-Extending Mutations

Genetic mutations that have been identified to increase lifespan or significantly extend the healthy, disease-free period of an organism's life.

Reproductive Fitness

The ability of an individual or genotype to reproduce successfully and pass genes to the next generation.

Q27: The greatest common divisor of 20/30 is:<br>A)

Q75: S corporations flow-through income amounts to its

Q98: What are intermediate sanctions and to what

Q99: The trade or business of selling merchandise

Q112: Willful and reckless conduct.<br>A)Taxpayer penalty<br>B)Tax preparer penalty<br>C)Appraiser's

Q115: Which, if any, of the following is

Q122: Reasonable cause will justify election.<br>A)Revocable trusts<br>B)Income in

Q125: State income taxes accrued prior to death.<br>A)Deductible

Q131: The election of § 2032 (alternate valuation

Q158: Credit for tax on prior transfers (under