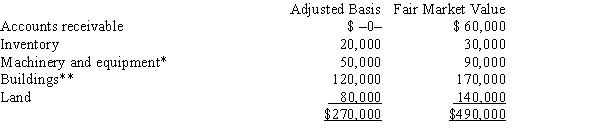

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Hematocrit

The ratio of the volume of red blood cells to the total volume of blood, expressed as a percentage.

Abbreviation

A shortened form of a word or phrase, used to represent the full term.

Blood Groups

Classification of human blood based on the presence or absence of inherited antigenic substances on the surface of red blood cells.

Complete Blood Count

A blood test that assesses red cells, white cells, platelets, hemoglobin, hematocrit, and other blood components.

Q13: Not an exempt organization<br>A)League of Women Voters.<br>B)Teachers'

Q26: All exempt organizations which are subject to

Q37: For Federal income tax purposes, a distribution

Q57: The IRS employs about 90,000 personnel, making

Q62: A taxpayer penalty may be waived if

Q64: TEC Partners was formed during the current

Q66: The tax treatment of S corporation shareholders

Q89: Transferring funds to shareholders, that are deductible

Q97: Which of the following is not typically

Q105: Barb and Chuck each own one-half of