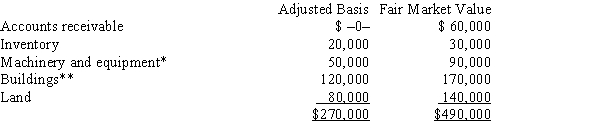

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Informed Consent

A process whereby a patient or participant agrees to a medical procedure or participation in research after understanding its risks, benefits, and alternatives.

Prevent Lawsuits

Strategies or measures taken to avoid legal actions being brought against an individual, organization, or company.

Defamation of Character

The act of communicating false statements about a person that injure that person's reputation.

Implied Contract

A contract that is created by the acceptance or conduct of the parties rather than the written word.

Q15: Tax-exempt income at the corporate level flows

Q28: The release of a valuation allowance may

Q29: Simpkin Corporation owns manufacturing facilities in States

Q40: The accumulated earnings tax rate in 2014

Q47: Create, Inc., a domestic corporation, owns 90%

Q55: Qwan, a U.S. corporation, reports $250,000 interest

Q90: Dan receives a proportionate nonliquidating distribution when

Q92: Limited liability partnership<br>A)Includes the partner's share of

Q103: An S corporation may not amortize its

Q111: A partnership is required to make a