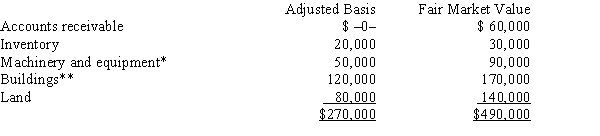

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Practical Intelligence

A type of intelligence that involves the ability to solve everyday problems through skilled reasoning that one may not have been formally taught.

Analytical Intelligence

Analytical Intelligence is a facet of intelligence that involves the ability to analyze, evaluate, judge, compare, and contrast.

Aptitude Test

A standardized test designed to measure an individual's potential to succeed in a particular activity or field of study.

Eugenics

A controversial science aimed at improving the genetic composition of the human race through selective breeding.

Q11: Which of the following income items does

Q15: Tom and William are equal partners in

Q16: On January 1, 2015, Kinney, Inc., an

Q42: Depletion in excess of basis in property

Q50: Tax on excess business holdings<br>A)May be subject

Q61: Federal agencies exempt from Federal income tax

Q71: Michelle receives a proportionate liquidating distribution when

Q74: If a business entity has a majority

Q74: Precontribution gain<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q82: An IRS "office audit" takes place at