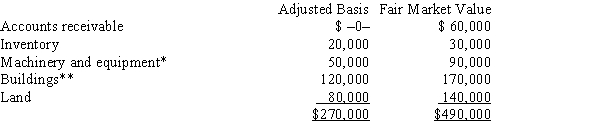

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Q8: Form 1023<br>A)Return of Private Foundation.<br>B)Application for Recognition

Q16: S corporation status always avoids double taxation.

Q27: Normally a distribution of property from a

Q29: Disproportionate distribution<br>A)Cash basis accounts receivable, for example.<br>B)Fair

Q64: The AMT tax rate for a C

Q88: Deduction for advertising expenditures.<br>A)Addition modification<br>B)Subtraction modification<br>C)No modification

Q88: An S shareholder's stock basis is reduced

Q96: Harry and Sally are considering forming a

Q99: A sole proprietorship files Schedule C of

Q156: GoldCo, a U.S. corporation, incorporates its foreign