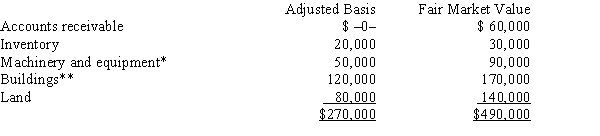

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Concepts

Abstract ideas or mental symbols that represent elements of reality, organizing knowledge in ways that facilitate understanding and communication.

Images

Visual representations, either mental or physical, of an object or scene.

Mental Age

A concept used to describe the intellectual capability of a person, expressed as the age at which an average individual reaches the same level of understanding or ability.

IQ

A measure of a person's intelligence, usually represented as a score derived from standardized tests.

Q11: IRS computers use document matching programs for

Q14: Treasury Bond interest income.<br>A)Addition modification<br>B)Subtraction modification<br>C)No modification

Q16: On January 1, 2015, Kinney, Inc., an

Q33: The operations of 80% or more owned

Q45: Yates Corporation elects S status, effective for

Q49: The individual seller of a used auto

Q72: While the major objective of the Federal

Q75: The IRS targets high-income individuals for an

Q125: Which item is not included in an

Q157: Winnie, Inc., a U.S. corporation, receives a