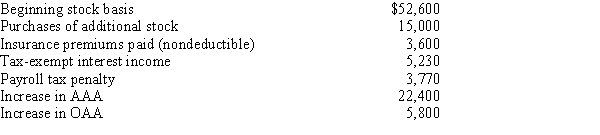

You are a 60% owner of an S corporation. Calculate your ending stock basis, based upon these facts.

Definitions:

Transgendered Individuals

Individuals whose gender identity or gender expression differs from the sex they were assigned at birth.

Biological Sex

The classification of living beings, generally as male or female, based on their reproductive anatomy and functions.

Gender Labels

Terms that classify or categorize individuals according to their perceived or assigned gender.

Work Outside

Refers to employment or activities that are conducted in open environments, away from traditional office settings.

Q3: To the extent of built-in gain or

Q3: Syndication costs<br>A)Organizational choice of many large accounting

Q5: Arnold purchases a building for $750,000 which

Q12: Which tax provision does not apply to

Q52: Bob received a proportionate nonliquidating distribution of

Q60: Plus, Inc., is a § 501(c)(3) organization.

Q76: The unrelated business income tax (UBIT) is

Q77: Adams Corporation owns and operates two manufacturing

Q89: Entity concept<br>A)Organizational choice of many large accounting

Q126: When the net accumulated taxable losses of