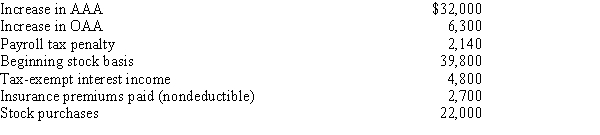

You are given the following facts about a 50% owner of an S corporation. Compute his ending stock basis.

Definitions:

After-Tax Discount Rate

The rate used to discount future cash flows after taxes in investment analysis to find their present value.

Incremental Sales

The additional revenue generated from a particular business action or decision, beyond what would have been generated without it.

Operating Expenses

Expenses incurred through normal business operations, such as rent, utilities, and salaries.

Renovation Cost

The total expenses incurred in refurbishing and restoring a building or facility to either improve it or bring it back to its original condition.

Q4: Substantially appreciated inventory<br>A)Cash basis accounts receivable, for

Q18: All organizations that are exempt from Federal

Q27: Tax on taxable expenditures<br>A)5% initial tax and

Q46: Bilateral agreement between two countries related to

Q50: USCo, a U.S. corporation, receives $700,000 of

Q78: Columbia, Inc., a U.S. corporation, receives a

Q95: Which of the following statements regarding the

Q118: Wood, a U.S. corporation, owns Holz, a

Q132: An S shareholder's stock basis can be

Q140: USCo, a U.S. corporation, reports worldwide taxable