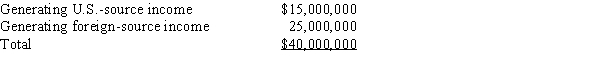

Goolsbee, Inc., a U.S. corporation, generates U.S.-source and foreign-source gross income. Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Definitions:

Q13: If an S corporation's beginning balance in

Q26: Puffin Corporation's 2,000 shares outstanding are owned

Q26: After a takeover, the parent's balance sheet

Q30: Acquiring Corporation transfers $1 million of its

Q30: Partner's capital account<br>A)Adjusted basis of each partnership

Q37: All affiliates joining in a newly formed

Q56: In the current year, Dove Corporation (E

Q75: Magenta Corporation acquired land in a §

Q105: Dividends received deduction<br>A)Group item<br>B)Not a group item

Q114: Mark and Addison formed a partnership. Mark