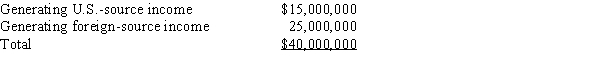

Goolsbee, Inc., a U.S. corporation, generates U.S.-source and foreign-source gross income. Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Definitions:

Dividends Paid

The sum of money paid by a company to its shareholders out of its profits or reserves.

Cash Flow

The aggregate circulation of cash and cash-like resources transitioning into and out of an enterprise.

Creditors

Individuals, banks, or other entities that lend money or extend credit to others, with the expectation of being repaid, often with interest.

Book Value

A financial metric that represents the net asset value of a company, calculated by subtracting total liabilities from total assets.

Q19: In order to retain the services of

Q24: Allison is a 40% partner in the

Q26: You are given the following facts about

Q31: Which of the following is not a

Q73: Keep Corporation joined an affiliated group by

Q74: Falcon Corporation ended its first year of

Q78: Kristie is a 30% partner in the

Q88: Penalties paid to state government for failure

Q113: Which item does not appear on Schedule

Q138: Which of the following determinations requires knowing