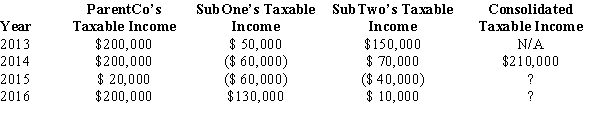

ParentCo, SubOne and SubTwo have filed consolidated returns since 2014. All of the entities were incorporated in 2013. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  How should the 2015 consolidated net operating loss be apportioned among the group members?

How should the 2015 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Creativity

The ability to generate new ideas, solutions, or products that are both novel and appropriate.

Realistic Accuracy Model

A framework for understanding how accurate personality judgments are made, focusing on the availability, detection, and utilization of relevant information.

Talkativeness

The quality of being inclined to talk frequently or at length.

Attendee

An individual who is present at an event, meeting, or gathering.

Q8: Harvey, a real estate developer, pays Abe,

Q15: Thistle Corporation declares a nontaxable dividend payable

Q56: When substantially all of the assets of

Q67: On August 31 of the current tax

Q74: Which of the following statements is true?<br>A)

Q82: If a distribution of stock rights is

Q85: Korat Corporation and Snow Corporation enter into

Q109: Alyce owns a 30% interest in a

Q114: Catherine's basis was $50,000 in the CAR

Q117: In a proportionate liquidating distribution, Sam receives