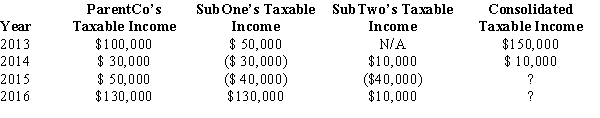

ParentCo and SubOne have filed consolidated returns since 2012. SubTwo was formed in 2014 through an asset spin-off from ParentCo. SubTwo has joined in the filing of consolidated returns since then. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Featheredged Tire

A condition of a tire where the tread ribs are rounded on one edge and sharp on another, typically due to misalignment.

Anti-Roll Bars

Components of a vehicle's suspension system designed to reduce body roll during sharp turns or irregular road conditions, enhancing stability.

Excessive Camber

When a vehicle's wheel tilt either inward or outward too much, leading to uneven tire wear and potential steering issues.

Excessive Caster

A condition in the alignment of vehicle wheels where the caster angle is beyond the recommended specification, affecting steering and stability.

Q2: Nicholas is a 25% owner in the

Q3: Ruth transfers property worth $200,000 (basis of

Q21: Technical termination<br>A)Includes the partner's share of partnership

Q35: Conformity among the members of a consolidated

Q39: Leon owns 750 shares of the 2,000

Q40: Gabriella and Juanita form Luster Corporation. Gabriella

Q43: Liquidating distribution<br>A)Cash basis accounts receivable, for example.<br>B)Fair

Q50: Grackle Corporation (E & P of $600,000)

Q69: Distribution of cash of $10,000 to a

Q70: Lori, a partner in the JKL partnership,