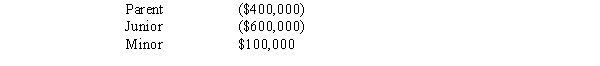

The Nannerl consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Junior.

Definitions:

Groups Of Friends

Social clusters or assemblies of individuals who share common interests, engage in activities together, and provide mutual support.

Reciprocity Principle

A social norm that suggests that people are inclined to return favors or kindness, establishing mutual exchange and cooperation.

Fundraising Letters

Written appeals for financial support sent by nonprofit organizations to potential donors.

Return Address Labels

Stickers or printed pieces of paper used to indicate the sender's address on mailed items.

Q11: Which of the following statements is correct

Q22: In determining whether § 357(c) applies, assess

Q44: Which of the following statements regarding the

Q61: Erica transfers land worth $500,000, basis of

Q66: The stock in Toucan Corporation is held

Q78: Step down<br>A)Includes the partner's share of partnership

Q86: Ownership level of parent at which a

Q87: Section 179 expense in second year following

Q123: A partnership may make an optional election

Q130: Julio, a nonresident alien, realizes a gain