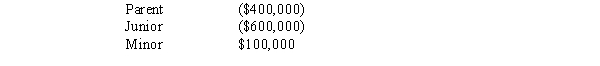

The Maestro consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Parent.

Definitions:

Autarky

An economic system where a country or entity is self-sufficient and does not engage in trade with external parties.

Comparative Advantage

The capability of an entity to generate a product or service with a lesser opportunity cost compared to others, resulting in enhanced trading efficiency.

Consumption Point

A specific point on a budget constraint that shows the combination of two goods that a consumer can afford.

Wheat

A staple grain that serves as a primary food source for a large portion of the world's population, used in a variety of products including bread, pasta, and cereal.

Q8: Foreign taxpayers earning income inside the United

Q14: If QPAI cannot be used in any

Q20: Reasonable needs for purposes of the accumulated

Q29: An exchange of common stock for preferred

Q30: During the year, Blue Corporation distributes land

Q41: Limited partnership<br>A)Organizational choice of many large accounting

Q65: The W-2 wages limitation as to the

Q65: ParentCo and SubCo recorded the following items

Q124: The Crimson Partnership is a service provider.

Q152: Which of the following is a special