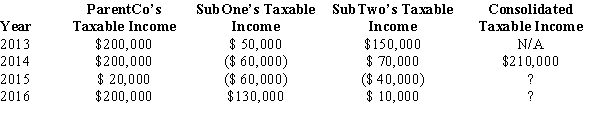

ParentCo, SubOne and SubTwo have filed consolidated returns since 2014. All of the entities were incorporated in 2013. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  How should the 2015 consolidated net operating loss be apportioned among the group members?

How should the 2015 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Scientific Notation

A way of expressing numbers that are too big or too small to be conveniently written in decimal form, using powers of 10.

Value

A piece of data or information that can be stored in a variable, passed as a parameter, or returned by a method in programming.

Invalid Identifier

A term used in programming for a name that does not follow the defined naming conventions or rules for identifiers.

Java

A class-based, high-level object-oriented programming language built to minimize implementation dependencies as much as possible.

Q7: Kipp, a U.S. shareholder under the CFC

Q13: For consolidated tax return purposes, purchased goodwill

Q35: If a parent corporation makes a §

Q43: If a partnership allocates losses to the

Q55: Pink Corporation declares a nontaxable dividend payable

Q61: Erica transfers land worth $500,000, basis of

Q74: Falcon Corporation ended its first year of

Q75: Which of the following statements regarding the

Q82: In a "Type A" merger, the acquiring

Q106: Rose Corporation (a calendar year taxpayer) has