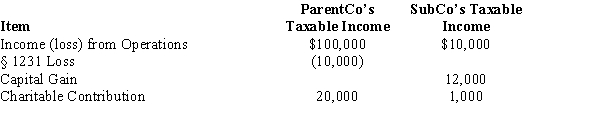

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

Definitions:

Systematic Desensitization

A therapeutic technique used to gradually reduce fear or anxiety about a specific object, situation, or activity by slowly increasing exposure.

Transcranial Magnetic Stimulation

A noninvasive procedure that uses magnetic fields to stimulate nerve cells in the brain, often used in the treatment of depression and other disorders.

Memory Loss

The inability to remember information or experiences, which can be temporary or permanent.

General Anesthetic

A type of anesthesia used to induce unconsciousness and a pain-free state during surgical procedures, affecting the entire body.

Q6: Proceeds of life insurance received upon the

Q11: Blue Corporation has a deficit in accumulated

Q25: Rust Corporation distributes property to its sole

Q27: In connection with the construction of a

Q30: Inventory with a basis of $10,000 and

Q58: Four years ago, Don, a single taxpayer,

Q68: Organizational costs<br>A)Adjusted basis of each partnership asset.<br>B)Operating

Q74: Which statement is false?<br>A) The overall tax

Q105: Dividends received deduction<br>A)Group item<br>B)Not a group item

Q151: In working with the foreign tax credit,