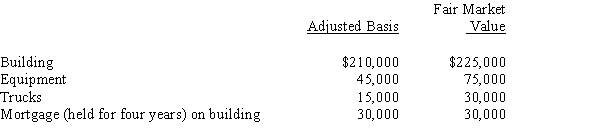

Rick transferred the following assets and liabilities to Warbler Corporation.

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

Definitions:

Cheating On Agreements

The act of knowingly violating the terms of an agreement or contract, often to gain an unfair advantage or benefit.

Cartels

Formal agreements among competing firms to control prices or exclude entry of a new competitor in a market.

Entry Barriers

Obstacles that prevent or hinder new competitors from easily entering an industry or area of business.

Collusion

An agreement between two or more parties, often in a secretive manner, to limit open competition by deceiving or defrauding others of their legal rights, or to obtain an objective forbidden by law, typically by defrauding or gaining an unfair market advantage.

Q19: A jury trial is available in a

Q20: Tern Corporation, a cash basis taxpayer, has

Q24: A company with a NOL carryforward

Q58: Betty's adjusted gross estate is $9 million.

Q64: Income that is included in net income

Q69: Deferring recognition of an intercompany gain is

Q72: Tanver Corporation, a calendar year corporation, has

Q78: If given the exact same amount of

Q79: Cardiac muscle has a limited regenerative capacity.

Q109: ParentCo owned 100% of SubCo for the