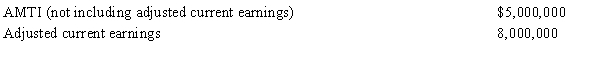

During 2015, Red Corporation (a calendar year taxpayer) has $4,000,000 of taxable income and the following transactions:

Red Corporation's alternative minimum tax (AMT) for 2015 is:

Definitions:

Machine-Hours

A measure of the amount of time a machine is operated, used as a basis for allocating manufacturing overhead to products.

Overhead Cost

Expenses related to the operation of a business that are not directly tied to a specific product or service, including rent, utilities, and administrative salaries.

Contribution Margin

The amount remaining from sales revenue after variable costs are deducted, indicating how much contributes to covering fixed costs and generating profit.

Wholesale Distributor

A business that buys goods in large quantities from manufacturers and resells them in smaller quantities to retailers or other businesses.

Q8: The periosteum is a tissue that serves

Q8: To carry out a qualifying stock redemption,

Q10: Which of the following refers to a

Q16: Pursuant to a liquidation, Coral Corporation distributes

Q33: If stock rights are taxable, the recipient

Q49: Reginald and Roland (Reginald's son) each own

Q50: If these citations appeared after a trial

Q68: Which court decision is generally more authoritative?<br>A)

Q69: Costal cartilages join most ribs to the

Q82: Tax-exempt interest on state and local private