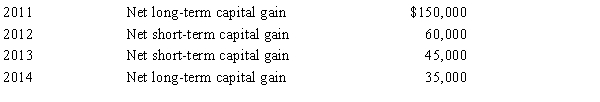

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2015. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2016.

Compute the amount of Carrot's capital loss carryover to 2016.

Definitions:

Marginal Utility

The supplementary utility or enjoyment obtained by consuming an additional unit of a good or service.

Consumer Surplus

Consumer surplus is the difference between the total amount that consumers are willing and able to pay for a good or service and the total amount that they actually pay.

Deadweight Loss

Reductions in combined consumer and producer surplus caused by an underallocation or overallocation of resources to the production of a good or service. Also called efficiency loss.

Producer Surplus

is the difference between what producers are willing to accept for a good or service versus what they actually receive, due to market prices.

Q6: The skin cancer most likely to metastasize

Q10: Raul's gross estate includes 1,500 shares of

Q25: Which AMT adjustment would only be negative?<br>A)

Q29: An individual with a "double-jointed" thumb can

Q31: In order to induce Yellow Corporation to

Q36: A corporation must file a Federal income

Q40: On January 30, Juan receives a nontaxable

Q55: The objective of the AMT is to

Q62: What are the major functions of the

Q69: The adjusted gross estate of Debra, decedent,