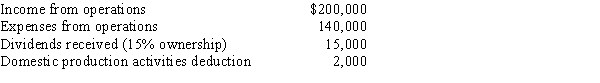

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Ingroup Favoritism

The tendency to give preferential treatment and express positive attitudes towards members of one's own group over those from other groups.

Outgroup Favoritism

The phenomenon where a person prefers and supports the members of a group they are not part of over their own group.

Social Identity

An individual's sense of who they are based on their group memberships, such as social, cultural, and occupational groups.

Ingroup Bias

The inclination to prefer individuals from one's own group rather than those from outside groups.

Q1: Lark City donates land worth $300,000 and

Q22: Only one judge hears a trial in

Q23: Internal Revenue Code § 6 involves gross

Q36: A corporation must file a Federal income

Q49: Reginald and Roland (Reginald's son) each own

Q55: All bones stop growing by the end

Q57: All of the following are factors that

Q72: The hyoid bone is unique because it

Q84: What is a constructive dividend? Provide several

Q86: During the current year, Hawk Corporation sold