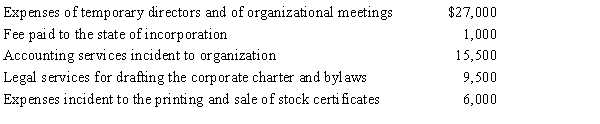

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2015. The following expenses were incurred during the first tax year (April 1 through December 31, 2015) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

Definitions:

Velocity

The rate of change of an object's position with respect to a frame of reference, showing both speed and direction of the object.

Segment

A part or section of something that is separated or distinct from the whole.

Decreases

The process or instance of becoming smaller or fewer in size, amount, intensity, or degree.

Velocity

The speed of an object in a specific direction, quantified as the distance covered per unit of time.

Q29: Immediately following the arrival of the stimulus

Q33: Thick skin has a more extensive dermal

Q35: Rigor mortis occurs because _.<br>A) sodium ions

Q35: Ivory Corporation, a calendar year, accrual method

Q54: Which hormone increases osteoclast activity to release

Q54: Liquidation expenses incurred by a corporation are

Q55: Of the following muscle types, which has

Q61: A personal service corporation with taxable income

Q61: Which trial court decision is generally less

Q85: A shareholder's basis in property acquired in