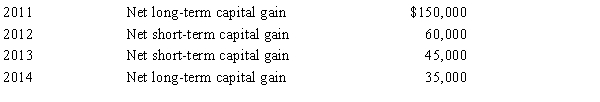

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2015. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2016.

Compute the amount of Carrot's capital loss carryover to 2016.

Definitions:

Buying Decision Process

Refers to the stages consumers go through before making a purchase, including problem recognition, information search, evaluation of alternatives, purchase decision, and post-purchase behavior.

Buying Decision Process

A series of steps a consumer goes through before, during, and after purchasing a product or service.

Prospective Buyer

A potential customer who has shown interest in a company's product or service and is considered likely to make a purchase.

FAB Selling Technique

A sales strategy emphasizing the Features, Advantages, and Benefits of a product or service to persuade potential customers.

Q4: Rajib is the sole shareholder of Robin

Q18: When a muscle is unable to respond

Q38: Stacey, Inc., has taxable income of $10

Q47: Art, an unmarried individual, transfers property (basis

Q52: Which of the following are cartilaginous joints?<br>A)

Q62: What are the major functions of the

Q62: The penalty tax rate for the AET

Q78: Rose Corporation, a calendar year corporation,

Q83: All vertebrae possess a body, a spine,

Q99: Cash distributions received from a corporation with