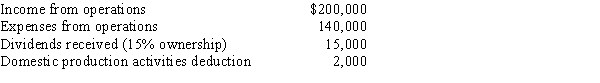

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Better Business Bureau Wise Giving Alliance

An organization that evaluates and accredits charities in the United States based on standards for charity accountability.

Earned-Income Strategies

Business activities initiated by nonprofit organizations that directly generate revenue as a result of the goods or services they offer, contributing to their financial sustainability.

Earned Income

Revenue generated from goods or services offered by an organization.

Partnerships

Cooperative relationships between people or groups, often formalized by agreements, working toward common goals or business ventures.

Q6: Which of the following movements does not

Q9: Determine the incorrect citation:<br>A) TAM 20002704.<br>B) George

Q11: Which of the following statements is correct

Q27: Dahlia owns $100,000 in Crimson Topaz preferred

Q54: Domestic production activities deduction claimed in 2015.<br>A)Increase<br>B)Decrease<br>C)No

Q58: Betty's adjusted gross estate is $9 million.

Q72: Cartilage has a flexible matrix that can

Q78: Rose Corporation, a calendar year corporation,

Q79: Nondeductible meal and entertainment expenses must be

Q94: Federal income tax paid in the current