Returns on Investment

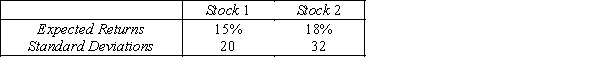

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Find the standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

Definitions:

Overhead Applied

A rephrased definition of Total Overhead Applied: The total amount of indirect costs assigned to products or services based on a predetermined rate, necessary for understanding product costs.

Assembly Department

A specific area in a manufacturing facility where components are put together to create a final product.

Predetermined Overhead Rate

An estimated rate used to assign manufacturing overhead costs to products, calculated before the costs are actually incurred.

Casting Department

A specific section within a manufacturing facility where metal casting processes take place, such as melting and shaping metals into desired forms.

Q29: In the Poisson distribution, the _ is

Q87: The Student t distribution with parameter v

Q114: The second set of branches of a

Q121: Initial estimates of the probabilities of events

Q127: {Messenger Service Narrative} Calculate P(B and O).

Q128: {Marital Status Narrative} Find the probability that

Q142: The relative frequency approach to probability uses

Q146: {Waiting Time Narrative} What is the probability

Q147: {Katie's Portfolio Narrative} If Katie is most

Q237: {Elizabeth's Portfolio Narrative} Describe what happens