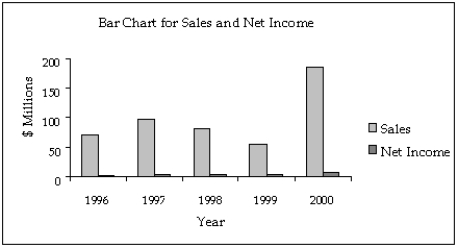

In its 2000 report, a company presented the following data regarding its sales (in millions of dollars), and net income (in millions of dollars). The bar chart below was used to present these data.  Assume that you are an unscrupulous statistician and want to make the data appear more positive than they really are. Redraw the graph by being selective about which years to include, getting the desired effect.

Assume that you are an unscrupulous statistician and want to make the data appear more positive than they really are. Redraw the graph by being selective about which years to include, getting the desired effect.

Definitions:

Functional Currency

The functional currency is the currency of the primary economic environment in which an entity operates and conducts its business transactions.

Balance Sheet Items

Components that make up a balance sheet, including assets, liabilities, and shareholders' equity.

Historic Rate

The exchange rate used to convert foreign currency transactions to the reporting currency at the date of the transaction, for accounting purposes.

Income Statement Items

Elements found in the income statement, including revenues, expenses, gains, and losses, which together determine the net income of a company.

Q11: The graph below represents a line graph.

Q15: What does the length of each line

Q45: The strength of the linear relationship between

Q46: The first scatter diagram below shows a

Q63: "Wouldn't you agree that foreign cars are

Q68: If two events are collectively exhaustive, what

Q87: A(n) _ distribution lists the categories of

Q110: What statistics and graphs can you use

Q135: Of the last 500 customers entering a

Q228: If A and B are mutually exclusive,